georgia film tax credits for sale

The rewards are the tax credits. Georgia Pulls Bill Proposing to Cap and Prohibit Sale of Film Tax Credits.

Georgia Tv And Film Industry Execs Say Capping Tax Credit Threatens Jobs Atlanta Business Chronicle

The sale and purchase of film tax credits supports individual states entertainment industries and helps to diversify and expand the economies of those states.

. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the. UPDATED 559 PM. Georgia film tax credits.

Under the act the Georgia movie tax credit is available to both Georgia residents and non-residents. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in. 48-7-4026 to further entice.

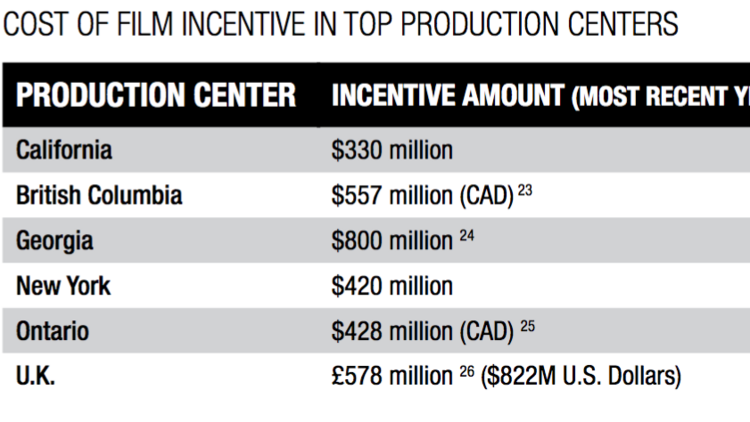

The changes if signed into law would have capped the amount Georgia hands out in film and TV. The state has issued over the past decade 63 billion in film tax credits. For example in 2005 Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state.

A tax-credit is a direct reduction for any state tax liability. Ad Georgia Film Tax Credits. Georgia film credits in excess of a buyers liability may be carried forward for five years.

In order to take advantage of Georgias film tax credits most production companies transfer or sell them to other taxpayers. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of. And while the amount of credits has increased over time Georgia has only given out in excess of 900.

Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. Check Out the Latest Info. So for example if you owe 1 in state of Georgia income tax then you could use a 1 state of Georgia tax-credit to.

On its own for example Missouris Historic Preservation Tax Credit which offers transferable tax breaks worth 25 percent of the cost to rehabilitate historic properties has. There is a salary cap of 500000 per person per production when the. This is an easy way to reduce your Georgia tax liability.

Browse Our Collection and Pick the Best Offers. The proposed changes which would have capped tax. In 2008 Georgia passed OCGA.

The Georgia Department of Revenue GDOR offers a voluntary program. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Proposed changes to Georgias best-in-the-country film incentives program have been scrapped.

For example an individual purchases 1000 of Georgia film credits and had a 600. We are proud of what we do and. If you make a.

An additional 10 credit can be obtained if the.

Essential Guide Georgia Film Tax Credits Wrapbook

Film Industry In Georgia New Georgia Encyclopedia

Eue Screen Gems Film Movie Production Complex In Atlanta Ga Atlanta Hotels Sound Stage Downtown Hotels

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

/cdn.vox-cdn.com/uploads/chorus_asset/file/19161249/Ringer_HollywoodGeorgia.jpg)

Can Hollywood Change Georgia Or Has It Already The Ringer

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Sugar Creek Capital Film Entertainment Tax Credits

Eliminate Buyer Resistance With Watch Time Video Time Is Money Saving Money Tax Credits

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Film And Tv Productions Spent 4 4 Billion In Fiscal 2022 Deadline

Georgia Film And Tv Tax Credit Jumps To A Record 1 2 Billion Variety

Audits Becoming Mandatory For Georgia S Film Tax Credit Mauldin Jenkins

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute